Contact Us

Client Services

888-474-2252

support@pgcalc.com

Monday – Friday

8:30 – 6:00 ET

The Client Services team provides assistance for PG Calc’s software clients.

Amy M. Brown, Client Services Advisor

Jahvari Freeman, Client Services Assistant

Jeffrey Frye, Associate Director for Gift Planning

Kara Morin, Senior Director of Planned Giving Services

What's New

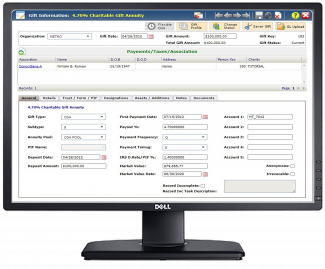

This GiftWrap and Bequest Manager release includes numerous improvements.

GiftWrap and Bequest Manager were updated on November 12, 2025. Please clear your browser cache before logging into GiftWrap and Bequest Manager. GiftWrap 4.3.10 contains a variety of enhancements that further increase the value and utility of PG Calc’s suite of gift administration software. This release focuses on fixes, small enhancements, upgrading of components, and overall usability. New features include:

- Undistributed Investment in Contract (UIC) can be recalculated in GiftWrap.

- Under Payments, a new dropdown filter, Annuity Pool (When Specific Org selected), has been added allowing you to run a payment summary by pool using a dropdown rather than a custom filter.

- PIF Partial Year State can be used to mark a person for residency in another state for a partial year for other gift types such as charitable gift annuities and charitable remainder trusts. This field is viewable in the 1099 Data Upload File.

- Negative fee values are now accepted in CashTrac.

These enhancements and others are further detailed in the GiftWrap 4.3.10 Release Notes. Look for the Latest Product Info link at the top of your screen within the application.

If you have any questions, please do not hesitate to contact PG Calc Client Services at 888-474-2252 or support@pgcalc.com. We look forward to helping you get the most out of GiftWrap and Bequest Manager.

GiftWrap Support Topics

These brief topics will point you in the right direction, but clients are always welcome to contact Client Services for assistance at 888-474-2252 or support@pgcalc.com. Clients will also find detailed instructions in the GiftWrap HELP system.

1099-R deadlines are as follows:

January 31, 2022 - Paper forms to annuitants

February 28, 2022 - Paper forms to the IRS

March 31, 2022 - Electronic form to the IRS – required if more than 500 1099-Rs

1099-Rs are produced based on the data in the Tax Schedule in the Association Information screen, not the data in the Payment Schedule. GiftWrap can produce correct 1099-Rs even if the system is not used to produce payments:

- Run Verify Person and Gift Data in the Utilities menu and correct any errors

- Run Year End Update in the Actions menu to bring your Organization Year to 2022

- In the 1099-R Forms interface, set Tax Year to 2021

- Use PDF, not Report Viewer, as the Display Option

This issue arises because GiftWrap produces the 1099-R information in the precise size required to fit data into the little boxes on the pre-printed 1099-R forms, but many printers and some browsers automatically resize before printing.

You can identify the resizing issue because the data will typically print a little too low relative to the boxes on the top half of the 1099-R form and too high on the bottom half. The trick is to persuade your printer to print the GiftWrap data without alteration.

In the Print Dialog window, look for the setting that controls sizing. Printer drivers use different terms, but you want “Page Scaling” set to “None” or “Actual Size” or “100%”. In Chrome, there is a checkbox labeled “Fit to page” and this box must be Unchecked.

GiftWrap License and Service FAQ

No, GiftWrap and Bequest Manager licenses are concurrent. This means, for example, if your organization has two licenses, only two people can logon simultaneously but any number of individuals may have login credentials and can take turns using the software.

Yes, licenses may be reassigned to different users by contacting Client Services. Licenses may not be reassigned to a different organization.

The GiftWrap License is a click-thru agreement and the text can be viewed any time in GiftWrap or Bequest Manager by clicking Help on the Menu Bar, clicking Index, and typing “License” in the Keyword field.

The License Fee is a one-time fee, and the Service Fee is renewable annually.

Our guarantee to:

- Keep the software current with all tax, regulatory, and related changes that affect planned gifts, compliance and tax forms; software updates.

- Unlimited telephone and email support.

- Complimentary software orientations.

- A monthly eRate eNewsletter.

- A quarterly Calc-U-Letter.

First, try the Forgot Password link on the Login screen. PG Calc can provide your Clientname and Username if needed to help you use Forgot Password.

If Forgot Password doesn’t work:

- If you are the “Primary Administrator”, call 888-474-2252.

- If you are not the “Primary Administrator”, call the person in your organization that has that role.

PG Calc can only reset passwords for the Primary Administrator. We are not able to reset passwords for any other user.