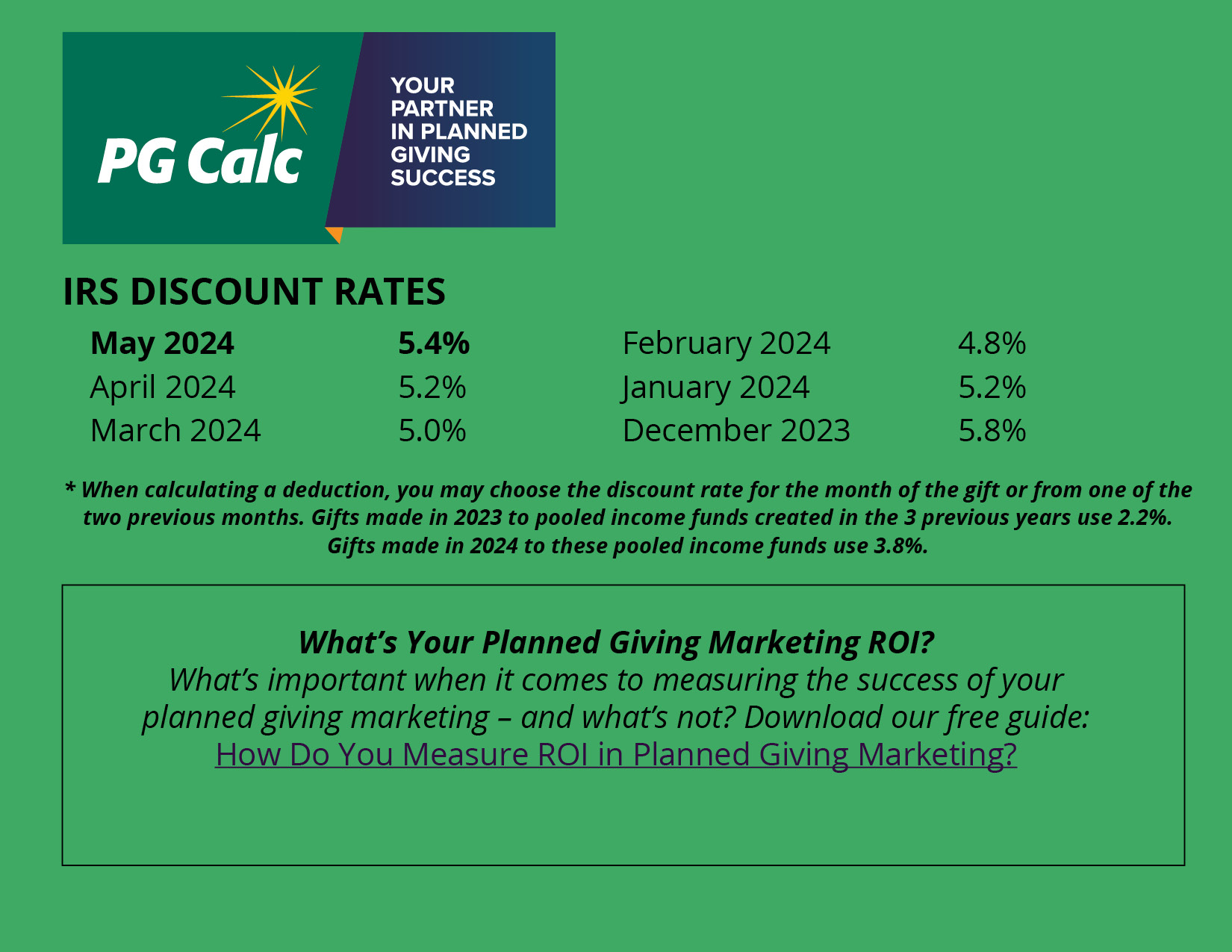

Information About the Discount Rate

Also known as the AFR or Applicable Federal Rate, the IRS discount rate is part of the calculation used to determine the charitable deduction for many types of planned gifts, such as charitable remainder trusts and gift annuities. The rate is the annual rate of return that the IRS assumes the gift assets will earn during the gift term.

When you are calculating a planned gift deduction, you may use the discount rate for the month in which the gift is made or for either of the prior two months. The rate equals 120% of the annual federal mid-term rate, rounded to the nearest 0.2%. The annual federal mid-term rate is the average annual yield over the past 30 days of Treasury instruments that have remaining maturities of 3-9 years.

The IRS discount rate is published monthly and is announced on or about the 20th of the month that precedes the month to which the rate will apply. For example, the rate for October is announced around September 20th.

Most clients take advantage of Planned Giving Manager’s and Gift Annuity Manager’s ability to update themselves automatically with the latest IRS discount rate via the internet. To enter the rate manually into PGM or GAM instead, choose Customize IRS Discount Rate Table and click Add. PG Calc maintains the IRS discount rate for its web-based products PGM Anywhere and GiftCalcs.

In a nutshell -- the higher the IRS discount rate, the higher the deduction for charitable remainder trusts and gift annuities, and the lower the deduction for charitable lead trusts and retained life estates. Fluctuations in the IRS discount rate affect unitrust deductions far less than annuity trust and gift annuity deductions. IRS discount rate fluctuations don’t affect pooled income fund deductions at all.

Additional Resources

As a service to the planned giving community, we are pleased to publish the latest IRS discount rate, as well as articles on topics of interest to gift planners, in our monthly eRate electronic newsletter. We email all subscribers around the 20th of each month. shortly after the rate for the next month becomes available.