Planned Gift Donors Deserve Highly Effective Stewardship

Although there are subtle differences between administration of different kinds of planned gifts, PG Calc knows them well and handles them all.

When your donors know that they will receive their payments and tax forms in a timely fashion (and without errors), you build trust with them. Building trust with donors is key to receiving more gifts.

We'll help you with all the nitty and gritty details that come with administering your planned giving program. We handle payments, send out tax forms, track gift values, and maintain gift data for you.

Planned Gift Administration Features

- We maintain your database of donors.

- We pay your donors correctly and on time.

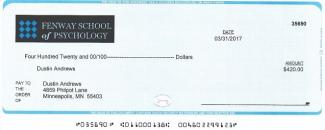

- We use your logo on checks or pay electronically.

- We send 1099-Rs or K-1s accurately and on time.

- We file your 1099-Rs electronically with the IRS.

- We compute the values of each annuity quarterly.

- We create state reserve reports for the states you need.

- We create FASB liability reports for your auditors.

What It's Like to Work With Us

Our staff has decades of experience in the operation of planned giving programs, solicitation of planned gifts, and administration of all giving arrangements. When you partner with PG Calc, this expertise is at your disposal. Working with your asset manager, we provide complete back-office administrative services for gift annuities, pooled income funds, and charitable remainder trusts.

Many of our charity customers tell us that outsourcing gift administration to PG Calc gave them the flexibility to choose the asset managers in whom they had the most confidence, rather than having to select a financial partner from the short list of those that also offer gift administration.

When PG Calc does your mailings, you can have us insert materials for your donors, customize the message on their check stub or EFT advice, and always have your organization’s logo on your checks. By leveraging your organization’s branding, you can ensure that your donors are continuously reminded of your mission and your value.

We can also work with you to execute other aspects of gift administration, including compliance reporting, helping you with process implementation, and auditing and evaluating your current gift administration procedures. Additionally, some programs will benefit from a thorough risk assessment designed to determine to what extent their gifts are likely to result in positive remainders.

The PG Calc Advantage

By combining deep technical and industry expertise with years of customer-centric experience, we effectively manage stewardship and compliance efforts for hundreds of charities and non-profit organizations.

Administers more than 12,000 gift annuity contracts

And nearly 100 pooled income funds