Gift planners are often surprised to see that the state named in the Governing Law paragraph in an annuity agreement is not always the same as the donor’s state of legal residence. Here’s why these states sometimes differ:

If the donor’s state of legal residence regulates charitable gift annuities, the donor’s state dictates whether specific content must be included in the annuity agreement. For instance, if a Massachusetts charity issues a gift annuity to a Florida resident, it must be a Florida agreement, which means including the specific disclosure language that Florida requires. While such language is the only content requirement in many states, others may have numerous requirements, including a provision on governing law.

Distinct from regulatory law that governs a charity’s issuance of a gift annuity in a particular state, governing law is used to enforce the terms (rights and obligations) of the contract. Some states, in dictating the content of the annuity agreement, require that their law be named as governing in gift annuity agreements for their residents. Those states are: Arkansas, California, Maryland, New Jersey, New York, and Washington. Other states are silent as to the governing law, which leaves the parties free to agree on what that law will be. For example, the agreement between a Massachusetts charity and a Florida donor might indicate Florida or Massachusetts as the governing law.

If you own PG Calc's Planned Giving Manager software, below there are instructions for how make the three state selections to ensure production of an annuity agreement that complies with state regulation and your organization’s choice of state for governing law:

Charity State and State for Governing Law

Typically, Charity State and State for Governing Law are set once and not changed.

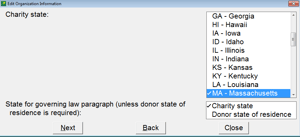

- Under the Customize menu, choose Organization Information, click the Edit button and then click Next until you reach the screen that provides for the selection of states for Charity and for Governing Law.

- The Charity State is most commonly the state where your organization was incorporated. However, if your organization is physically located in another state, then it might prefer to use the law of that state.

- Make your selection of State for governing law after consultation with your corporate counsel.

- If Charity State is selected, agreements produced by PGM will use the Charity state for governing law UNLESS the donor’s state of legal residence requires otherwise. In that case, the agreement will display the Donor state for governing law.

- To save your selections, go to the File menu on the Menu Bar, select Save Configuration and click Save.

Donor State of Residence

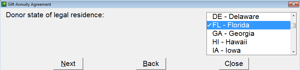

The Donor state of residence must be selected for each new contract.

- In PGM, enter all the facts of the current gift.

- In Presentation Selection, choose Gift Annuity Agreement.

- In Narrative Follow-up Questions, go through the questions for the gift annuity agreement and select the Donor state of legal residence.

The resulting agreement will satisfy state regulation and organizational policy.