Projecting Remainder Amounts for Bequest Gifts in PG Calc’s Bequest Manager Application

A healthy and robust planned giving program typically includes a broad array of split-interest gift arrangements – certainly the familiar life income gifts – charitable gift annuities, charitable remainder trusts, (perhaps) a pooled income fund, and occasionally even a retained life estate or two – but the largest portions of most programs invariably consist of bequests and other gifts triggered upon the deaths of the donors. Whatever the variety in each organization’s program, the general idea is that the benefits to the charity will come at a later point in time. This means we are put in the position of expecting charitable gifts to be realized in the future, and we are presented with the challenge of how to estimate the values of those gifts over time.

PG Calc’s Bequest Manager application is a subset of the company’s venerable GiftWrap system, which is an industry-leading product specifically designed and built for the ongoing management and administration of planned gifts. Bequest Manager allows for booking donors’ intended bequests in a preliminary status as soon as each individual provides notice to the charity. While it is possible to enter a specific dollar value, it is also acceptable to enter the value as $1, simply as a placeholder, or one that represents a percentage of an estimated estate until more information becomes available. If the donor eventually provides an idea of the true amount of the bequest, the value can be modified to reflect the updated information.

The intended bequest gifts that are recorded during the donors’ lifetimes are further broken down, depending on whether or not the donor has provided any substantiating material. The bequest intention may be categorized as “undocumented,” meaning that the donor has not supplied any supporting documentation, or the gift may be labeled as “documented,” which means that the donor has provided something specific to back up the promise – and the charity gets to decide exactly which types of documents are sufficient.

When the charity receives notification of a donor’s death, all bequest gifts associated with that donor essentially move into the active stage of bequest management. This stage can consume a tremendous amount of time and effort on the part of the organization’s staff, and Bequest Manager is an amazing tool for assisting with those efforts. There are many categories of active bequests – In Process, In Probate, In Partial Distribution, In Litigation, to name just a few. These differentiations are enormously helpful in the effort to project the timeframe between notification of death and final receipt of funds.

There are also distinctions between the types of transfers and types of assets. With the choice of the type of transfer, the organization can specify if the bequest will come by will, by revocable living trust, by beneficiary designation, or by some other means. Bequest Manager also allows the user to specify the exact nature of the assets to be received – the most frequent choice will be cash, of course, but there is an extensive array of other choices. Remember to count any type of gift that matures and is realized upon the death of the donor as a bequest gift, meaning that assets, such as insurance policies, retirement accounts, and even real estate, should be recorded as bequest intentions. All of this information is good, of course; and each organization can maintain a seamless thread of activity for each bequest gift, from initial notification of intention, through the active stages of managing the bequest gift, to the ultimate settlement and receipt of funds.

But our intention here is to focus more specifically on the ability to predict the future results of the bequest gifts program by use of a function called “Projected Remainder Amounts.” Certainly, bequest gifts that are in the active stages can be included in any projection, but this functionality is best suited for those gifts still in the intention stages. The charity can and should be recording every mention of an intended bequest gift by a donor, and that information is valuable by itself, but when it is used to project the ultimate realized amounts in the future, the results can be astounding.

Let’s review briefly what is involved in projecting the future realized amount of each bequest gift intention. First and foremost, we would need to consider the age of the donor. We have all kinds of estimates of remaining life expectancies, and nobody ever dies “on schedule,” but we have to make some sort of guess about when the bequest will be realized. Bequest Manager allows for the selection of many different mortality tables – some are created by the federal government and are gender-neutral, while others are created by the insurance industry and are gender-specific. No particular table is right or wrong, but we suggest that the organization should maintain consistency when choosing a particular table.

Another significant element is assigning a value to the bequest gift. As mentioned above, the charity can book bequests as zero, or $1, essentially as placeholders, but it is also possible to enter the nominal value of the stated intention or some estimate thereof. For example, the donor may be intending to leave the residue of her retirement plan to the organization. There might be $500,000 in the plan at the moment, but the charity can decide if it wants to discount that number simply because the donor may end up using a significant portion over her remaining years.

In addition to the initial value to be booked, consideration must be given to the level of confidence in the gift intention. Is this a donor with little or no history of giving to the organization, or is she someone who has given reliably over the years? Have there been any major gifts over the years, or even better, has there been a pledge at any point, and did the donor fulfill the pledge? The charity gets to decide whether a particular intention is highly likely, somewhat likely, etc., but in addition, the charity gets to assign a percentage of probability to the gift in Bequest Manager. A $1 million bequest intention is certainly exciting, but if the donor provides no documentation to substantiate the gift, and if the relationship with the donor in recent years is spotty at best, what is the realistic probability of that gift maturing and at that amount?

One last aspect to think about is the loss of purchasing power over the years until each bequest gift is realized. While inflation has been relatively low in recent years, the long-term historical average does have a real effect in situations where the donors are relatively young and where the gifts will take many years to mature. Some organizations choose to discount bequest intentions up from – they set a particular age as the threshold, below which bequest intentions are discounted at the outset, and above which intentions are recorded at face value. This is certainly a good idea when there isn’t an ability to discount the realized amounts at the end, but with the present value discounts available in Bequest Manager, organizations are able to apply discounts based on the number of years reflected in the life expectancies.

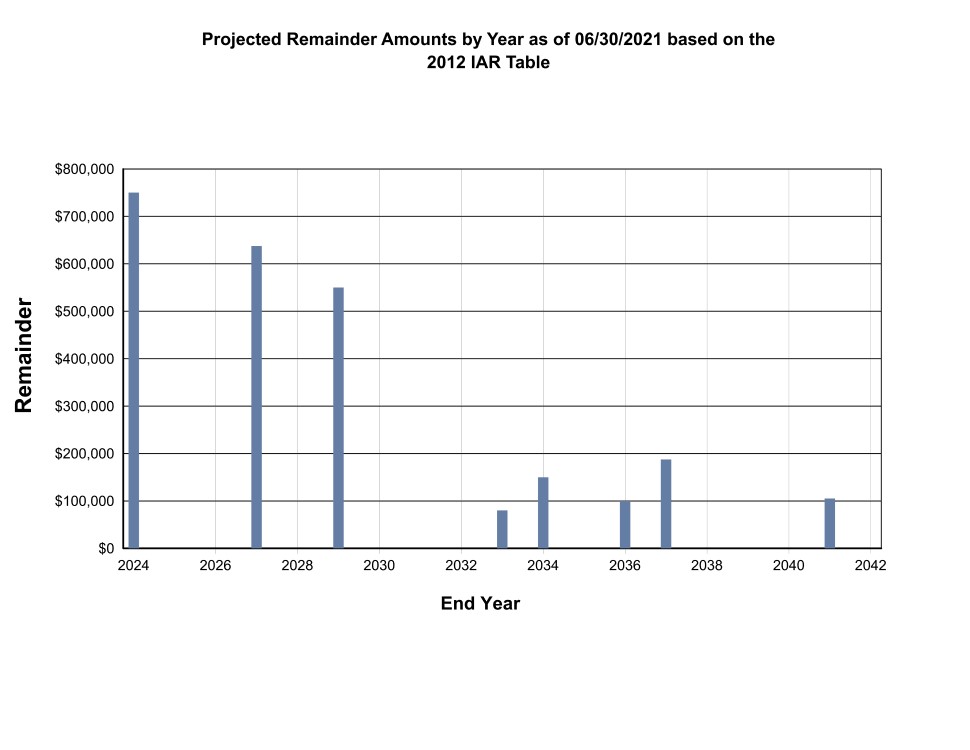

Bequest Manager produces all kinds of reports, including reports for projected remainder amounts, but sometimes a picture really is more valuable. Below is a sample of a bar graph showing the expected maturities of bequest gifts over the next 20 years.

You can see that there are large amounts anticipated from realized bequest gifts over the next seven to eight years (the report was run on a June 30 fiscal year), but there are very few amounts anticipated after that. Any organization would be thrilled to anticipate close to $2 million in matured bequest gifts between now and 2030, but there is clearly a need to gather more bequest intentions for the later years in this project. Looking at the underlying data, the reality is that the development people have done a great job cultivating bequest intentions from donors who are now in their eighties and nineties, but there are very few intentions on record associated with donors who are in their seventies, and there are no intentions in the database for donors in their sixties.

Some of that is logical, of course, because older donors are generally more likely to have communicated about a bequest intention, but the relatively younger donor base represents an area ripe with opportunity. Even the Baby Boomers who thought they would never grow old have now landed in their sixties and seventies, and there is extraordinary potential within that age group. If the Baby Boomers are now in the stages of retiring, they are also in the process of (at least) starting to think about their legacies and what they will leave behind. Having this kind of projection report gives the charity exactly the information that is needed to pursue new bequest intentions with the most appropriate groups of donors.

In summary, charitable organizations with planned giving programs need to maintain records of all their bequest gifts, starting with the intention stages. The most basic information should be gathered initially upon notification of a bequest intention – and in most cases, the donor is already in the database, because they’ve established a pattern of giving over the years. The information about the gift intention up front helps the charity to spring into action immediately upon notification of the death of the donor. The preliminary information will make the process of managing the settlement of the bequest gift much less troublesome and frustrating, and having all of the cumulative information about bequest gifts, both intended and received, in one database, will help the organization to be more successful in the future with efforts to encourage bequest giving. But perhaps the most powerful impact an application like Bequest Manager can have is in providing a glimpse into the future – to provide an estimate, albeit approximate, of how much money will be realized from the future maturities of bequest gifts over an extended period of time. Donors don’t die strictly based on actuarial tables, of course, and no one can predict the events of the future, but having a rough idea of how much money is coming, and when it is coming, is invaluable for an organization charting its course over the coming years.