All Boats Were Lifted: 2024 Another Strong Year for Traditional Investments

-Last year at this time, we were talking about how well traditional investment portfolios had done in 2023. After a truly disastrous performance in 2022, the stock market came roaring back in 2023, and the bond side held its own. Long-term performance averages seemed reliable again, and investors regained their confidence. So how did traditional investment portfolios do in 2024? As it turns out, they did quite well. Roughly speaking, the investment performance for traditional investment portfolios in 2024 was a repeat of the robust performance in 2023. Let’s take a look at some of the details.

After 2023, Are We Back to Normal?

-A year ago, we published an article under the tongue-in-cheek title of “That’s Alright, It Was Only Money.” We wanted to update our understanding of historical performance results for traditional investment portfolios after the disastrous conclusion of the year 2022. We used the S&P 500 Index as the benchmark for stocks and Barclay’s Aggregate Bond Index as the benchmark for fixed income. In 2022, the former ended the year with a return of minus 13.01%, and the latter ended the year with a return of minus 19.44%. That meant our prototypical investment portfolio, invested 50% in stocks and 50% in bonds, saw a blended investment return of minus 16.23%. At the time, we pointed out that the aggregate performance for 2022 was actually worse than the aggregate performance for the Great Recession year 2008, which was “only” minus 15.88%.

And now, after another year in the books, but with quite different results in 2023, we ask the question, “Are we back to normal?” It’s probably a rhetorical question, and it begs a more specific question: “What is normal, anyway?” The S&P 500 return in 2023 was 24.23%, and the Barclays Aggregate Bond Index return was 5.53%, resulting in a blended return of 14.88%. It was a great year for investment portfolios holding traditional asset classes! The improved numbers should make everyone feel a little better off. Does it give us greater confidence to make the argument that over many years, a prudent investor strategy results in positive returns? Let’s take a look at the actual numbers.

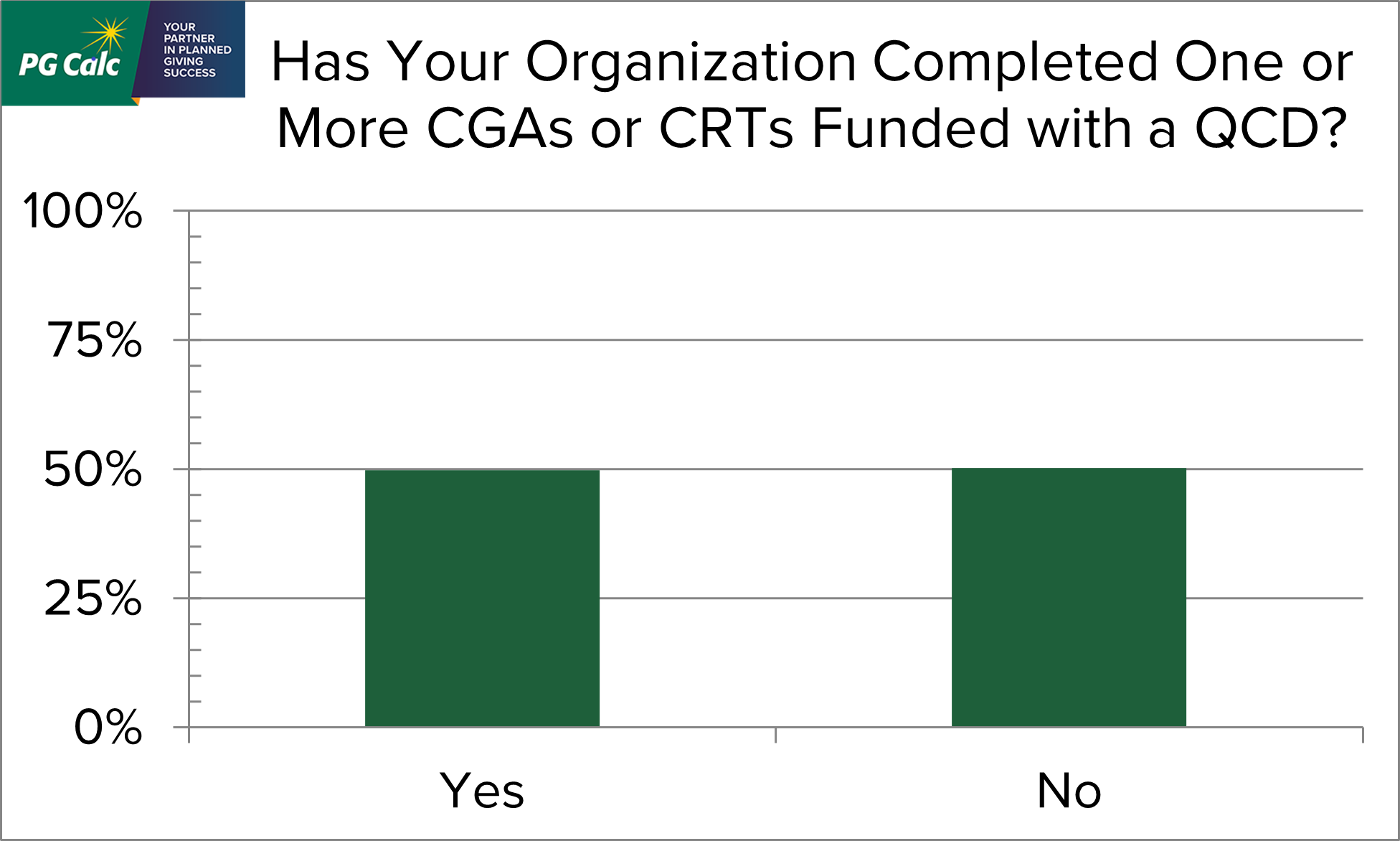

PG Calc QCD Survey: Many Charities Report Closing CGAs Funded With a QCD

-

A new gift planning opportunity became available at the beginning of this year thanks to the Legacy IRA Act that passed late last December: funding a charitable gift annuity (CGA) or charitable remainder trust (CRT) with a qualified charitable distribution (QCD) from one’s IRA. Gift planners were rightfully excited to have a new gift plan to talk about with their donors. However, the new gift plan’s many requirements raised doubts about how popular it would be. Who would make these gifts? Now that we are most of the way through 2023, the QCD for life income plan’s place in planned gift fundraising has become clearer.

A new gift planning opportunity became available at the beginning of this year thanks to the Legacy IRA Act that passed late last December: funding a charitable gift annuity (CGA) or charitable remainder trust (CRT) with a qualified charitable distribution (QCD) from one’s IRA. Gift planners were rightfully excited to have a new gift plan to talk about with their donors. However, the new gift plan’s many requirements raised doubts about how popular it would be. Who would make these gifts? Now that we are most of the way through 2023, the QCD for life income plan’s place in planned gift fundraising has become clearer.

In their interactions with clients, our Client Services and Gift Administration teams have noticed a recent increase in the number of new CGAs funded with a QCD. This pattern piqued our interest. To investigate the popularity of this new gift option further, we sent out a survey to a broad fundraising audience. We summarize our results below.

That’s Alright – It Was Only Money (Putting 2022 in the Rearview Mirror)

-We’ve been saying for years that, when it comes to investments, charities should focus on the long-term picture. There are good years in the markets and bad years in the markets, but, with “prudent” investments, the long-term outcomes have been consistently positive. Whether it be the endowment assets of well-established organizations, or the investment portfolios of gift annuity programs and individual charitable remainder trusts, the general rule is to look at the bigger picture. But specific and dramatic swings in the investment markets – the stock market in particular – can have a chilling effect on donors with stock portfolios held over an extended period of time.

What do we say to the donors who have seen their investments lose significant value over the past 12 months or longer? And even within the organization, how do we respond to the more cautious voices among us who are spooked by double-digit declines in market values? We thought it would be helpful to take a look at the most recent investment performance measurements of mainstream investments.

Indexing the Qualified Charitable Distribution Amount

-The index adjustment uses the average Chained Consumer Price Index for All Urban Consumers (C-CPI-U) for each calendar year with 2022 as the base year. The average for a calendar year is taken from 9/1 of the previous year through 8/31 of the current year. Indexing starts with 2024, so the first adjustment will include 9/1/2021 - 8/31/2023. A fair estimate is that there will be an inflation adjustment of 10% to 15% for that period. If that is correct, the limit on outright QCDs would be between $110,000 to $115,000 and the limit on QCDs to a CGA would be between $55,000 to $58,000 (rounded $57,500 to nearest $1,000).

QCD to Life Income Gifts (the “Legacy IRA”) Frequently Asked Questions

-What is the “Legacy IRA”? Under certain circumstances, a donor can make a one-time tax-free Qualified Charitable Distribution (QCD) from their IRA in exchange for a life income gift. This is a once in a lifetime election, subject to the limitations explained below.

Rapid Ascent of IRS Discount Rate Creates Opportunities

-In February, the IRS discount rate was 1.6%. In December, it is up to 5.2%, more than triple what it was just ten months ago. This dramatic change coincides with a similar escalation of interest rates in the U.S. generally, as well as increased nervousness over whether the rapid rise in interest rates might soon tip the economy into a recession.

Don’t freak out over the swift shift in economic conditions. View it as an opportunity. This is a great time to renew contact with your donors and educate them about gift plans they might want to consider in this new economic reality.

The Other Five of the Top Ten Lessons Learned from the Front Lines of Client Services

-The world of planned giving is complex and fascinating. It is squarely at the intersection of philanthropy and estate planning, but it also overlaps with the areas of law, taxation, investments, and human behavior. There are so many nuances and specialty areas of knowledge that the gift planning professional can easily become overwhelmed and lose sight of the core issues. We at PG Calc hesitate to say, “we’ve seen it all,” but in some ways, we have!

We produce software for gift planning and gift administration, and we provide a wide array of services ranging from consulting to web services. We thought it might be helpful to pause for a moment and share what we’ve identified as the top 10 lessons (this is the first installment of 5) in planned giving that we have learned over the 37 years of our company’s existence. These are not necessarily in order of importance or relevance, and of course, they represent only a tiny portion of the knowledge required for any modern-day gift planner.

Five of the Top Ten Lessons Learned from the Front Lines of Client Services

-The world of planned giving is complex and fascinating. It is squarely at the intersection of philanthropy and estate planning, but it also overlaps with the areas of law, taxation, investments, and human behavior. There are so many nuances and specialty areas of knowledge that the gift planning professional can easily become overwhelmed and lose sight of the core issues. We at PG Calc hesitate to say, “we’ve seen it all,” but in some ways, we have!

We produce software for gift planning and gift administration, and we provide a wide array of services ranging from consulting to web services. We thought it might be helpful to pause for a moment and share what we’ve identified as the top 10 lessons (this is the first installment of 5) in planned giving that we have learned over the 37 years of our company’s existence. These are not necessarily in order of importance or relevance, and of course, they represent only a tiny portion of the knowledge required for any modern-day gift planner.

Never Surrender! (Or Surrender Now!) – The Relinquishing of Life Income Gifts

-One of the planned giving trends that has evolved in recent years is the voluntary termination of life income gift arrangements. While not a part of the original intent in the creation of these gift plans, surrendering the remaining lifetime income in these split-interest gifts has become popular for a number of reasons. Certainly, there are obvious benefits to the sponsoring charitable organizations – these terminations eliminate the charity’s ongoing liability for payments, and of course, they receive the remainder amounts sooner than otherwise would be the case – but there are also benefits to the donors who relinquish their interests.