Bigger Is Not Always Best, or Even Better

-You’re preparing an illustration, or maybe a marketing piece, and want to show the potential tax savings – both income and capital gains – from a planned gift. You’ll need to make several assumptions including the gift amount, ages, and tax rates. For the first two, gift amount and ages, you can be guided by what you know about your prospect or, for a marketing piece, your intended target market. But how are you going to select the tax rates?

It’s certainly appealing to show the largest possible tax savings, which argues in favor of using the highest possible tax rates: 37% for income tax and 20% for capital gains. (And you might even choose 40.8% for the income tax rate, because it’s conceivable that the 3.8% Net Income Investment Tax Surcharge might apply.)

Here’s the rub: very few taxpayers fall into the 37% tax bracket. Even fewer also fall into the 20% capital gains bracket.

Underrated: Falling Interest Rates and Charitable Gift Annuities

-We’ve been hearing quite a bit about the Federal Reserve system (“the Fed”) likely cutting the Fed Funds rate – the key interest rate that it controls – at its next Open Market Committee meeting, which is September 17-18. The Fed aggressively hiked the Fed Funds rate from February 2022 to August 2023 in a determined effort to bring down inflation, which peaked at over 9% in 2022. It has kept the Fed Funds rate at the same relatively high level for the past year. Lately, however, there have been various reports showing that the economy is showing signs of slowing down, and inflation in recent months has approached the Fed’s 2% target. This has led the Fed to signal it is finally comfortable with reducing interest rates.

When the Fed cuts the Fed Funds rate, other interest rates tend to follow suit – especially short-term and medium-term interest rates. Even long-term interest rates, such as mortgage rates, are eventually affected. And that brings us to the topic of charitable gift annuities (CGAs). We’ve been receiving calls over the past few weeks from gift officers questioning if, how, and when the declining interest rates in the economy will affect CGAs. Our client organizations are asking, should they be promoting gift annuities at current rates – so donors can “get in” before an overall reduction in payout rates?

That’s a great question and something worth talking about.

Have Gift Annuity Benefits Peaked for Donors?

-It is no secret that the American Council on Gift Annuities (ACGA) recently increased its suggested maximum annuity rates. The new rates, which went into effect on January 1 of this year, marked the third increase in the ACGA rates in the last 18 months. At typical annuitant ages, the current rates are roughly 1.5% higher than they were in June 2022. For example, the ACGA rate for a 75-year-old annuitant was 5.4% in June 2022 and is 7.0% today.

The larger story is that today’s ACGA rates are the highest they’ve been in 15 years. What does all this mean for gift annuities?

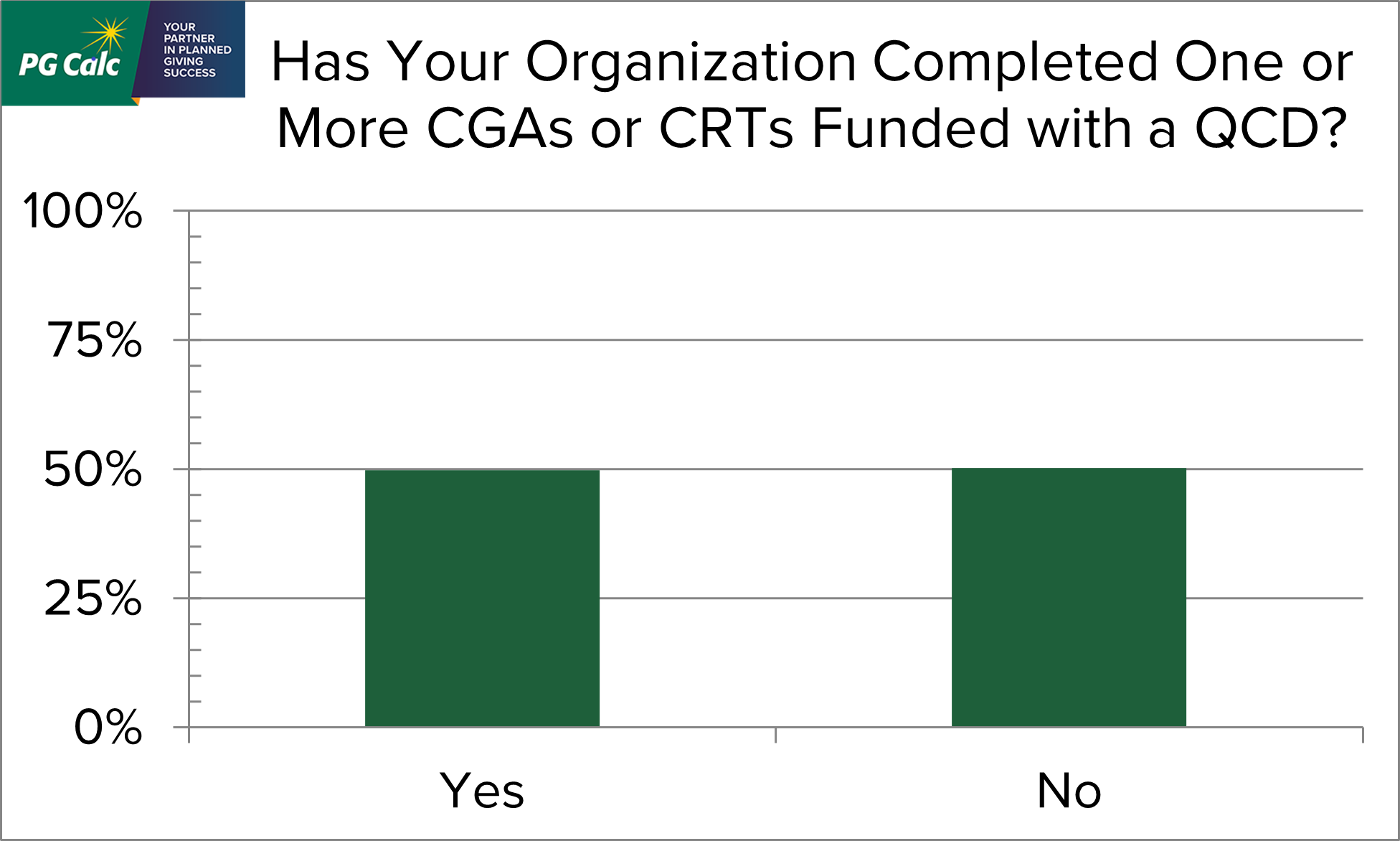

PG Calc QCD Survey: Many Charities Report Closing CGAs Funded With a QCD

-

A new gift planning opportunity became available at the beginning of this year thanks to the Legacy IRA Act that passed late last December: funding a charitable gift annuity (CGA) or charitable remainder trust (CRT) with a qualified charitable distribution (QCD) from one’s IRA. Gift planners were rightfully excited to have a new gift plan to talk about with their donors. However, the new gift plan’s many requirements raised doubts about how popular it would be. Who would make these gifts? Now that we are most of the way through 2023, the QCD for life income plan’s place in planned gift fundraising has become clearer.

A new gift planning opportunity became available at the beginning of this year thanks to the Legacy IRA Act that passed late last December: funding a charitable gift annuity (CGA) or charitable remainder trust (CRT) with a qualified charitable distribution (QCD) from one’s IRA. Gift planners were rightfully excited to have a new gift plan to talk about with their donors. However, the new gift plan’s many requirements raised doubts about how popular it would be. Who would make these gifts? Now that we are most of the way through 2023, the QCD for life income plan’s place in planned gift fundraising has become clearer.

In their interactions with clients, our Client Services and Gift Administration teams have noticed a recent increase in the number of new CGAs funded with a QCD. This pattern piqued our interest. To investigate the popularity of this new gift option further, we sent out a survey to a broad fundraising audience. We summarize our results below.

Measuring the Success of Your CGA Program: The Case for Maintaining Current Market Values for All Charitable Gift Annuities

-Charitable gift annuities (CGAs) are designed to be the split-interest gift for any donor. The basic premise is that the donor contributes cash or marketable securities to a charitable organization, and the charity promises to make payments to the donor for the rest of his or her life. The donor receives a charitable income tax deduction at the time of the gift, and some portion of the original principal remains at the donor’s passing.

That all sounds great, right? A classic “win-win-win” arrangement, and in fact, most charitable gift annuities result in a significant portion of the original principal as the residuum. When a charity has a robust gift annuity program, there can be enormous financial rewards from the ongoing stream of CGA terminations. But we’ve all heard the other side of the story as well. There are far too many examples where the gift corpus becomes completely used up, and in fact, the charity ends up kicking in money from general funds to continue making payments to an annuitant who lived beyond their original life expectancy. We call these “underwater gift annuities,” and they actually end up with negative dollar benefits.

So, what is the sum total benefit of this gift annuity venture from the charity’s perspective? Put simply, how does the charity even begin to measure the success of their CGA program?

Rapid Ascent of IRS Discount Rate Creates Opportunities

-In February, the IRS discount rate was 1.6%. In December, it is up to 5.2%, more than triple what it was just ten months ago. This dramatic change coincides with a similar escalation of interest rates in the U.S. generally, as well as increased nervousness over whether the rapid rise in interest rates might soon tip the economy into a recession.

Don’t freak out over the swift shift in economic conditions. View it as an opportunity. This is a great time to renew contact with your donors and educate them about gift plans they might want to consider in this new economic reality.

Don’t Be Scared Off by CGA Regulations

-For any charity operating a gift annuity program, the question, “In what states do we need to register?” has likely come up (perhaps more than once). That may be closely followed by a declaration “we’re not registering in…” and the naming of one or more states accompanied by horror stories of the level of regulation they impose. Although complying with state gift annuity regulations does not top anyone’s “things I enjoy” list, the desire to avoid a certain state’s regulations can interfere with the success of your program.

Fortunately, a charity can issue in half of the states without being subject to any gift-annuity-specific registration, and if you tack on the 14 states that require only a notice of intent to issue, then the total grows to 39 states. The complexity really comes with the 11 more highly regulated states: Alabama, Arkansas, California, Florida, Hawaii, Maryland, New Jersey, New York, North Dakota, Tennessee, and Washington. While for some organizations their donor base is such that they want to be able to issue gift annuities in all states, for many it will make sense to weigh the cost (in time and dollars) of compliance with the benefit of expected gifts.

The question of where to register and issue should take into account the geographic reach of an organization and where it might have donors, but also the level of regulation in a given state as compared to the potential for gifts.